8 May 2025

In March 2025, a troubling financial scandal surfaced when a Chinese businessman alleged that staff at a Singapore-based family office stole US$55.57 million, as reported by The Star. (source: https://www.thestar.com.my/aseanplus/aseanplus-news/2025/03/19/chinese-businessman-alleges-us5557mil-theft-by-singapore-based-family-office-staff#goog_rewarded). This incident exposed critical vulnerabilities in managing substantial wealth without robust oversight, raising concerns among family offices globally. The case underscores the vital role of third-party fund administration in safeguarding assets, ensuring transparency, and preventing fraud and errors. This article explores the details of the alleged theft, illustrates how it occurred and how fund administration could have prevented it, and explains why an independent fund administrator is essential for family offices. By partnering with external experts, family offices can protect their wealth and focus on their core mission of wealth preservation and growth.

The Alleged Theft: A Wake-Up Call for Family Offices

According to The Star, a Chinese businessman accused employees of a Singapore-based family office of misappropriating US$55.57 million through unauthorized transactions and fraudulent activities over an extended period. The allegations suggest that internal staff exploited their access to the family office’s accounts, executing transfers to external accounts that went undetected due to inadequate monitoring and weak internal controls. The businessman claims the theft was facilitated by a lack of independent oversight, poor segregation of duties, and insufficient reporting mechanisms, allowing the errors or fraud to persist until significant losses were incurred.

While US$55.57 million is a substantial sum, the case is particularly alarming because it occurred in Singapore, a global hub for wealth management renowned for its financial sophistication and regulatory standards. Family offices in Singapore often manage diverse, high-value portfolios across multiple jurisdictions, making them attractive targets for internal fraud/errors if controls are lax. The incident highlights a critical vulnerability: even in a highly regulated environment, relying solely on internal staff—however trusted—can expose family offices to significant risks.

The consequences of the alleged theft extend beyond financial loss. The family office’s reputation has been tarnished, and the incident may trigger legal disputes or regulatory scrutiny. For the businessman, the breach of trust by internal staff underscores the need for impartial, professional oversight. This case serves as a cautionary tale, urging family offices worldwide to reassess their operational frameworks and prioritize robust safeguards to protect their wealth.

How the Theft Happened and How Fund Administration Prevents It

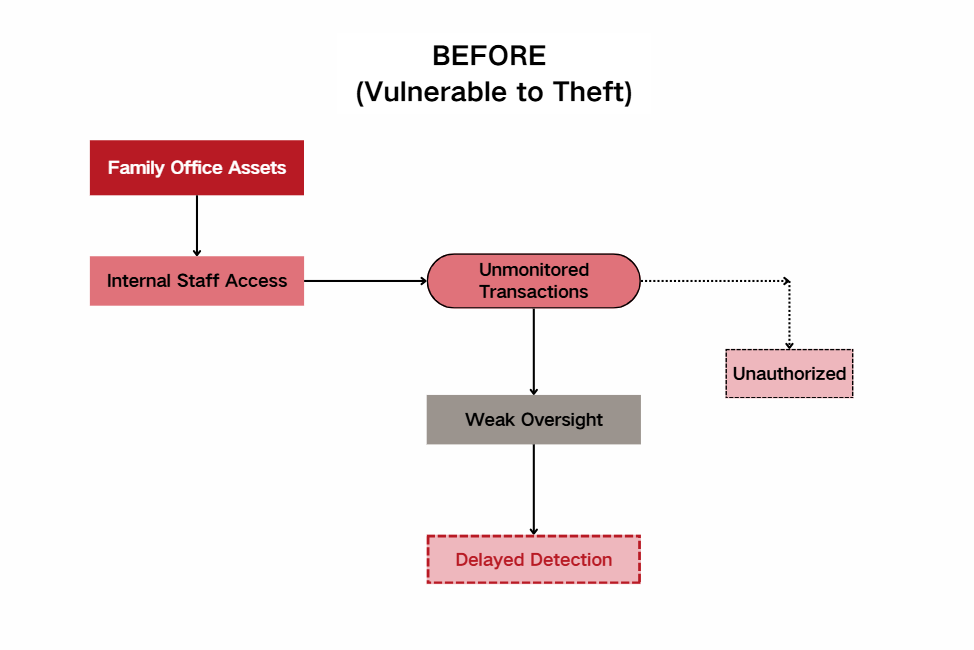

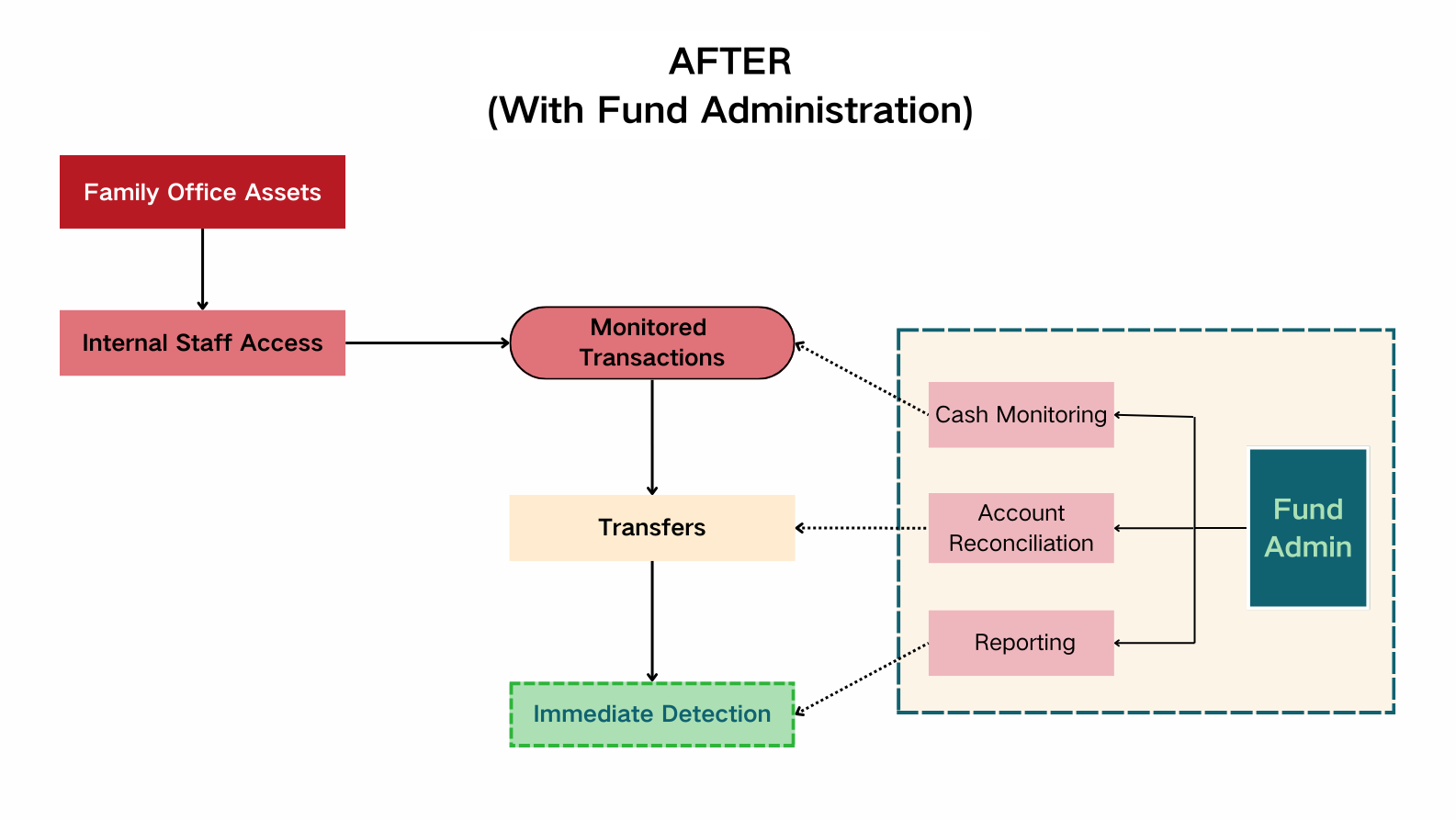

To understand the mechanics of the alleged theft and the transformative role of third-party fund administration, consider the following diagram comparing the family office’s operations before and after engaging fund administration services:

Detailed Explanation of the Diagram:

Before (Vulnerable to Theft):

• Family Office Assets: The family office manages a diverse portfolio, including cash, equities, real estate, and alternative investments, often held across multiple accounts.

• Internal Staff Access: Employees have broad access to financial systems, with minimal restrictions, enabling them to initiate and execute transactions independently.

• Unmonitored Transactions: Transactions are processed without real-time scrutiny, allowing staff to manipulate records or initiate fraudulent transfers to external accounts.

• Unauthorized Transfers: Funds, in this case allegedly US$55.57 million, are siphoned off through unauthorized instructions, such as falsified wire transfers or payments to shell entities.

• Weak Oversight: The absence of independent audits or standardized processes means irregularities go unnoticed, as internal reviews are often informal or infrequent.

• Delayed Detection: The theft is discovered only after significant losses, typically through manual reconciliation or external complaints, by which time recovery is challenging.

After (With Fund Administration):

• Family Office Assets: Assets remain unchanged but are now protected by a layered oversight framework managed by the fund administrator.

• Internal Staff Access: Staff access is restricted (i.e. maker-checker mode or the 4-eyes-principles) and monitored, with fund administrators enforcing segregation of duties to prevent any single individual from controlling all transaction stages.

• Monitored Transactions: Fund administrators deploy advanced cash monitoring systems to track all cash flows in real time, flagging anomalies like unusual transfers. Multi-layered approval processes ensure high-value transactions require independent authorization.

• Robust Oversight: Regular independent accounting and NAV calculation to the underlying portfolio and reconciliations compare internal records with external sources (e.g., bank statements, custodian reports), ensuring accuracy and identifying discrepancies promptly.

• Immediate Detection: Comprehensive, transparent reporting provides family office principals with real-time insights. Automated alerts and dashboards enable swift identification of suspicious activity, preventing significant losses.

This comparison illustrates how fund administration transforms a vulnerable operation into a secure one. Fund administrators as an independent 3rd party with secure approval workflows create a fortified system that prevents errors/fraud. In the Singapore case, these measures could have flagged unauthorized transfers early, potentially saving US$55.57 million by stopping the theft before it escalated.

Why Third-Party Fund Administrator is Essential

Family offices normally manage complex portfolios, often spanning multiple jurisdictions, asset classes (e.g. PEVCs, listed securities, crypto assets etc), and investment strategies (e.g. direct investments, fund of funds, SMA, passive investments). While internal teams may excel in strategic investment decisions, they often lack the technical expertise, impartiality, or resources to implement rigorous operational controls. Third-party fund administrators fill this gap, offering specialized skills, advanced technology, and an independent perspective that enhance security and efficiency to facilitate the institutionalization of a family office. Their role complements internal staff, ensuring that operational processes are robust and transparent.

Here are the key benefits of third-party fund administration:

• Independent Oversight: External administrators operate without conflicts of interest, providing unbiased scrutiny of transactions and records. This impartiality is critical for detecting internal fraud or errors that might be overlooked by in-house teams.

• Cash Monitoring: Sophisticated systems track cash movements across accounts, to detect irregularities such as unexpected outflows or transfers to unfamiliar entities. This oversight ensures rapid response to potential issues.

• Robust Accounting: Administrators maintain meticulous records that adhere to industry standards, ensuring accuracy and transparency. This reduces the risk of errors and facilitates discrepancy detection during the daily operations.

• Risk Mitigation: By enforcing segregation of duties, multi-layered approvals, and regular reconciliations, administrators minimize the risk of unauthorized actions. These controls create a checks-and-balances system that deters fraud.

• Scalability and Expertise: Fund administrators bring deep expertise in managing complex portfolios, allowing family offices to scale operations without compromising security. Their knowledge of best practices ensures processes remain cutting-edge.

• Peace of Mind: With professional oversight, family office principals can focus on strategic goals, confident that their assets are protected. This reduces stress and enhances decision-making.

• Reputation Protection: Robust controls signal to stakeholders that the family office operates with integrity, safeguarding its reputation against scandals like the Singapore case.

For example, a typical single family office managing its global investments might rely on internal staff for investment decisions but lack the systems to monitor cash flows effectively. Without external oversight, a rogue employee could initiate fraudulent transfers, as allegedly occurred in Singapore. A fund administrator’s cash monitoring and approval processes would have flagged such activity, while regular audits would have ensured accountability. This layered approach prevents fraud and strengthens operational resilience.

Key Procedures Fund Administrators Implement to Prevent Fraud

Third-party fund administrators employ a suite of procedures to safeguard family office assets, each addressing specific vulnerabilities. Below is a detailed breakdown of these processes, their implementation, and their impact:

• Segregation of Duties:

- What It Involves: Administrators divide transaction responsibilities among multiple parties. For instance, one team member initiates a transfer, another approves it, and a third reconciles the records, ensuring no single individual has end-to-end control.

- How It Prevents Errors: This structure eliminates the ability of a single employee to execute fraudulent transactions without oversight, reducing the risk of collusion or unilateral misconduct.

- Implementation: Administrators use role-based access controls in financial systems, ensuring permissions are clearly defined and monitored.

- Impact: In the Singapore case, segregated duties would have required multiple approvals for transfers, preventing staff from moving US$55.57 million undetected.

• Cash Monitoring:

- What It Involves: Independent 3rd party role and a well-trained team continuously tracks cash flows, analyzing transaction patterns and flagging anomalies (e.g., large transfers, frequent small withdrawals, or payments to new accounts).

- How It Prevents Errors: Real-time alerts enable administrators to investigate suspicious activity immediately, halting unauthorized transfers before losses occur.

- Implementation: Read-only access (or payment maker access) to bank accounts and custodians, providing a unified view of cash movements.

- Impact: Early detection of unusual cash flows could have stopped the alleged theft, protecting the family office’s assets.

• Multi-Layered Approval Processes:

- What It Involves: High-value or sensitive transactions require approvals from multiple parties, including the fund administrator and family office principals.

- How It Prevents Errors: This ensures no single party can move large sums without scrutiny, making unauthorized transfers nearly impossible.

- Implementation: Secure workflows require digital signatures or dual authentication, with administrators acting as an independent gatekeeper.

- Impact: Such controls would have blocked the alleged fraudulent transfers, as staff would have lacked the authority to act alone.

• Comprehensive Reporting:

- What It Involves: Administrators provide detailed reports on asset performance, cash flows, and transaction histories, accessible via secure portals. Reports are tailored to the family office’s needs.

- How It Prevents Errors: Transparent reporting empowers stakeholders to monitor their wealth actively, question irregularities, and make informed decisions.

- Implementation: Automated reporting tools generate real-time dashboards and periodic summaries, with alerts for significant changes.

- Impact: Regular reports could have alerted the businessman to suspicious activity sooner, preventing prolonged losses.

The Path Forward: Strengthening Family Office Operations

The alleged US$55.57 million theft in Singapore is a stark reminder that internal controls alone cannot protect wealth from fraud or mismanagement. Third-party fund administration offers a proven solution, combining expertise, technology, and independence to safeguard assets. By integrating these services, family offices can mitigate risks, enhance transparency, and focus on their core objectives—wealth preservation and growth.

Selecting and Integrating Fund Administration Services

To maximize the benefits of fund administration, family offices must choose a provider that aligns with their needs. Key considerations include the provider’s track record, technological capabilities, and ability to customize services. For instance, a family office with a global portfolio may prioritize administrators with expertise in multi-jurisdictional operations and expertise across multiple asset classes, including listed equities, bonds, investment funds, private equities, and digital assets.

Integration begins with a thorough assessment of the family office’s current processes. Administrators collaborate with internal teams to map workflows, identify vulnerabilities, and implement controls like segregation of duties and cash monitoring systems. This collaborative approach ensures a seamless transition, with minimal disruption. Training programs can help staff adapt to new protocols, fostering a culture of accountability.

Once integrated, fund administration services provide ongoing value. Regular audits, real-time reporting, and proactive monitoring create a dynamic system that evolves with the family office’s needs. Over time, these services not only prevent fraud but also optimize operations, reducing costs and enhancing efficiency.

A Strategic Investment

The cost of fund administration is minimal compared to the potential losses from fraud or mismanagement. The Singapore case illustrates the severe consequences of inadequate oversight, both financially and reputationally. By contrast, family offices that invest in professional fund administration gain a competitive edge, demonstrating to stakeholders that their wealth is managed with integrity.

In an era of increasing financial complexity, third-party fund administration is not a luxury—it’s a necessity. For family offices looking to strengthen their operations, exploring these services is a prudent step. It’s an investment in security, transparency, and peace of mind—qualities that no amount of wealth can replace.

Precision’s Tailored Services for Family Offices in Alternative Asset Management

Precision is the trusted partner for family offices, delivering bespoke solutions tailored to their unique needs across a vast spectrum of alternative assets. From Fund of Hedge Funds and Crypto Funds to Private Equity, Venture Capital, Luxury Asset, Credit, and Real Estate Funds, our specialized expertise ensures meticulous NAV calculations, rigorous operational oversight, and seamless management of complex timelines and agreements.

For family offices, we provide unparalleled support, collaborating closely with underlying investments, verifying critical transactions, and maintaining the highest standards of operational integrity. Our tailored approach empowers family offices to confidently navigate the intricacies of alternative investments, cementing Precision’s position as a leader in family office-focused asset management.

Learn more about our services to family offices:

https://www.precisionfundservicesgroup.com/family_offices.html