23 May 2025

The Securities and Futures Commission (SFC) of Hong Kong has released new regulatory guidance governing staking services provided by licensed virtual asset trading platforms (VATPs) and SFC-authorised virtual asset funds (VA Funds). This move underscores Hong Kong's commitment to fostering a secure and innovative virtual asset (VA) ecosystem while prioritizing investor protection. Below is an analysis of the implications for the industry and key definitions underpinning the guidance.

What Does This Mean for the VA Industry in Hong Kong?

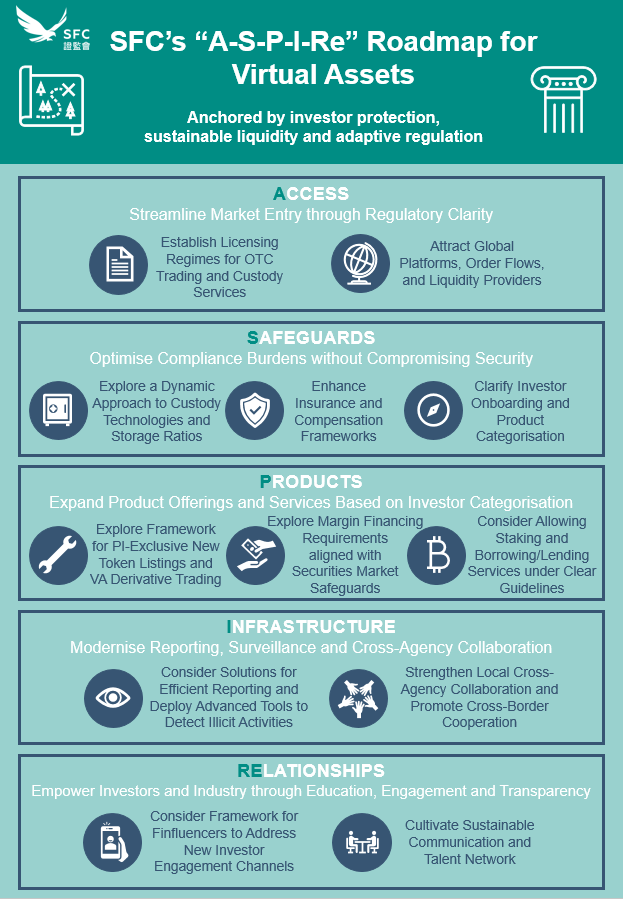

The SFC's guidance formalizes staking—a process where users lock virtual assets to support blockchain network validation—within a regulated framework. By allowing VATPs to expand product offerings under its "ASPIRe" roadmap (announced in February 2025), the SFC aims to:

This development reflects Pillar P (Products) of the "ASPIRe" roadmap, which seeks to broaden the suite of regulated VA products and services to sustain Hong Kong's competitiveness as a global VA hub.

Implications for VA Industry Service Providers

Service providers, including fund administrators, custodians, and compliance teams, must adapt to the new requirements:

These measures reinforce Hong Kong's emphasis on operational integrity and investor protection, as outlined in the SFC's revised circular on VA Funds (April 2025).

Key Definitions

An SFC-authorised VA Fund refers to an investment fund with exposure to virtual assets exceeding 10% of its net asset value (NAV), authorized by the SFC for public offering in Hong Kong. Such funds must comply with strict requirements, including:

Staking involves committing virtual assets to a blockchain validator to participate in network validation under a PoS mechanism. In return, participants earn yields. The SFC mandates that staking activities by VA Funds must be conducted through regulated entities to mitigate risks.

A VATP is an SFC-licensed platform enabling users to trade virtual assets. Licensed VATPs must adhere to stringent requirements, including client asset segregation, cybersecurity protocols, and real-time transaction monitoring.

The "ASPIRe" Roadmap: Bridging Innovation and Regulation

The SFC's "ASPIRe" roadmap (Access, Safeguards, Products, Infrastructure, Relationships) provides a strategic blueprint for Hong Kong's VA ecosystem. Key initiatives relevant to staking include:

As highlighted in the SFC's February 2025 announcement, these pillars aim to position Hong Kong as a leader in balancing innovation with investor-centric regulation.

What to Expect?

The SFC's staking guidance marks a pivotal step in Hong Kong's journey toward a mature VA market. By formalizing staking within a regulated framework, the SFC not only enhances blockchain security but also signals its readiness to support innovative financial products. For industry participants, adherence to these rules will be critical to navigating Hong Kong's evolving regulatory landscape while capitalizing on its growing prominence in the global VA economy.