28 Apr 2025

Introduction

In today’s complex investment landscape, regulatory compliance and operational transparency are non-negotiable pillars of trust. For private funds—particularly those managing alternative assets like cryptocurrencies, private equity, and hedge strategies—adhering to stringent asset segregation rules and robust Know Your Customer (KYC)/Anti-Money Laundering (AML) frameworks is critical. This article consolidates key requirements under the Cayman Islands' Segregation of Assets – Registered Private Funds rules and global AML standards, providing actionable insights to safeguard your fund’s integrity. (source: https://www.cima.ky/upimages/regulatorymeasures/RevisedRule-SegregationofAssets-PrivateFund_1599832964.pdf)

Key Terms Defined

1. Segregation of Assets:

The legal requirement to separate fund assets from those of managers, operators, or custodians (referred to as Section 17 Persons under the Private Funds Law, 2020).

2. Portfolio:

All financial assets and liabilities of a fund, including investor subscriptions, redemptions, and investments.

3. Section 17 Person:

A custodian appointed under Section 17 of the Private Funds Law (PFL) to hold fund assets, ensuring they remain distinct from operational accounts. For example, a virtual asset fund may need a qualified crypto custodian for the underlying crypto assets.

4. KYC/AML Compliance:

Processes to verify investor identities, monitor transactions, and mitigate risks of financial crimes, aligned with frameworks like FATF recommendations and GDPR.

Regulatory Requirements for Asset Segregation

Under the Cayman Islands Monetary Authority’s (CIMA) rules, registered private funds must:

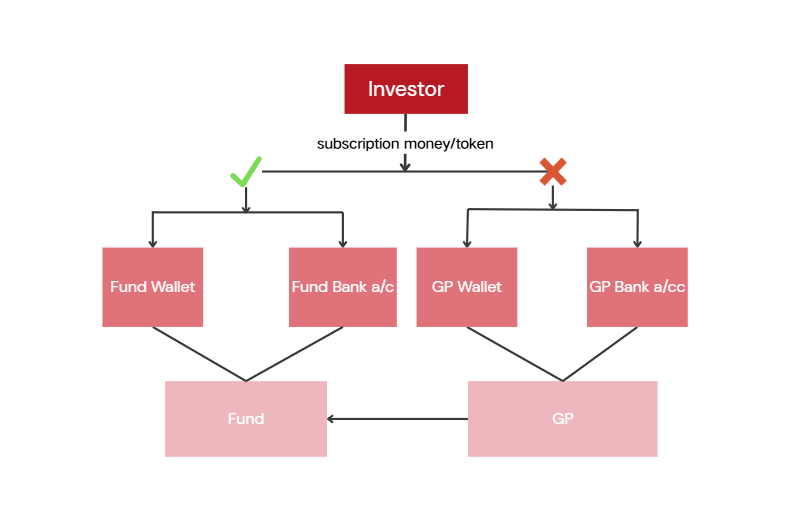

1. Maintain Strict Separation:

• Fund assets must be held in dedicated accounts/wallets, separate from those of managers, operators, or Section 17 Persons.

• Example: Crypto holdings must reside in fund-specific wallets, never co-mingled with a GP’s personal exchange accounts.

2. Prohibit Asset Misuse:

• Fund assets cannot finance operations of managers or custodians.

• Permitted Exceptions: Investor redemptions, disclosed fees, or consented transfers (with prior investor disclosure).

3. Implement Oversight Mechanisms:

• Operators must establish policies to ensure compliance, including regular audits and automated reconciliation systems.

High-Risk Scenarios & Solutions

Scenario 1: GP-Controlled Wallet for In-Kind Subscriptions

• Risk: A GP uses its own wallet (e.g., MetaMask) to receive USDT subscriptions, mixing fund and GP’s assets.

• Violation: potentially breaches segregation rules under Section 5.1 of the Cayman Islands’ regulations.

• Solution: Utilize fund-dedicated wallets managed by Section 17 Persons, with clear labeling and transaction tracking.

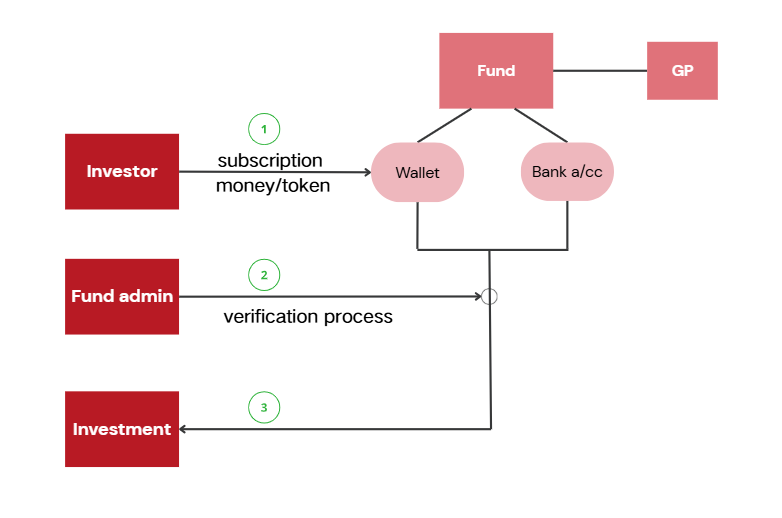

Scenario 2: Premature Deployment of Subscription Funds

• Risk: Deploying capital before completing KYC/AML checks or obtaining signed subscription forms.

• Consequence: Invalidates compliance and exposes the fund to regulatory penalties.

• Solution: Implement automated workflows to block fund usage until:

- Signed subscription agreements are received.

- AML/KYC screenings are finalized.

- Same-name transfers (bank or wallet) are confirmed.

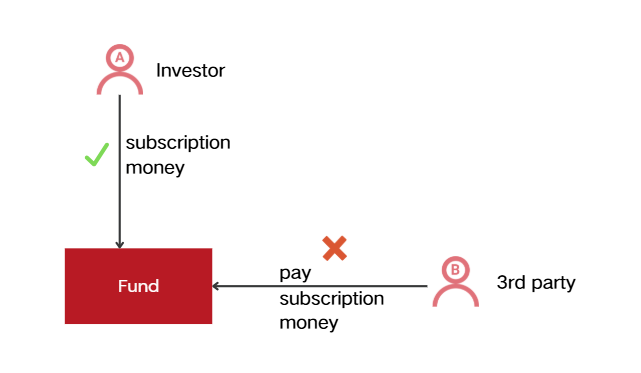

Scenario 3: Third-Party Payments

• Red Flag: Investor A subscribes, but funds originate from Investor B’s account.

• Compliance Failure: Violates “same-name” transfer rules and triggers AML alerts.

• Prevention: Enforce wallet/bank account whitelisting and blockchain analytics to trace transaction origins.

Operational Best Practices

1. Subscription Controls:

• Mandate same-name transfers aligned with KYC records.

• Restrict transactions to pre-approved wallets via whitelisting protocols.

2. Documentation & Workflow Automation:

• Release funds only after:

- Validated subscription agreements.

- Completed AML/KYC screenings.

- Confirmation of same-name transfers.

The Role of KYC/AML in Asset Protection

• Robust KYC/AML processes are foundational to asset segregation compliance:

- Investor Verification: Confirm identities using government-issued IDs and global sanctions lists.

- Ongoing Monitoring: Detect suspicious activities (e.g., third-party payments, PEP involvement).

- Regulatory Reporting: Automate filings with authorities like CIMA to avoid penalties.

Conclusion

In an era where regulatory scrutiny intensifies and investor trust is paramount, asset segregation and KYC/AML compliance are not optional—they are existential. By aligning with frameworks like the Cayman Islands’ Segregation of Assets rules and leveraging technology-driven solutions, funds can mitigate risks, enhance transparency, and build lasting credibility.